A “short-squeeze” that started on Wall Street has swept across the Atlantic, triggering another day of frenetic moves in the share prices of companies with large bets levied against them.

Stocks such as German pharmaceutical company Evotec, former Financial Times owner Pearson and Polish games developer CD Projekt rose strongly in intraday trading.

Some of the companies were targets of Melvin Capital, a hedge fund that has been singled out by day traders. The stocks included Evotec, which soared as much as 30 per cent before falling back to trade up 5.5 per cent; CD Projekt, which rose 15 per cent and was recently trading up 6.4 per cent; and German battery manufacturer Varta, which surged 12 per cent before trimming its gains to trade up 4.6 per cent.

The short squeeze in the US also continued on Wednesday, with shares of AMC, the cinema company, jumping more than 200 per cent in volatile action. GameStop, which has been at the centre of the retail trading bonanza, shot up by 100 per cent.

The dramatic moves highlight the growing influence of retail traders, who have organised on the message board site Reddit. The group has focused on pushing up stocks that are the subject of large “short bets” by hedge funds. Melvin, which has been at the centre of the storm, on Wednesday revealed it had closed its GameStop position, with the bets contributing to a multibillion-dollar loss at the start of this year.

Retail investors are using “a tried-and-true hedge fund strategy of swarming crowded trades held by weak-handed investors,” said Andrew Beer, managing member at fund firm Dynamic Beta Investments.

In contrast to in the US, which has limited disclosure on short bets, hedge funds and other investors have to disclose when they have shorted more than 0.5 per cent of a company’s stock in the EU and the UK, making it easier to target a fund’s positions.

Melvin’s latest disclosure shows it has bet against more than 6 per cent of Evotec’s shares, making it the largest single wager against a European company by percentage of shares shorted, according to data provider Breakout Point. The US hedge fund’s bet against Varta is the fifth largest.

The “short squeeze phenomena fuelled by retail investors’ discussions is spilling over to Europe”, said Ivan Cosovic, founder of Breakout Point. “We are recently detecting some European stocks being touted as 'the next GameStop’ among retail investors.”

The targeting of hedge funds will be viewed with irony by many financial market insiders, given that such funds are often the protagonists in short selling “attacks” on troubled companies.

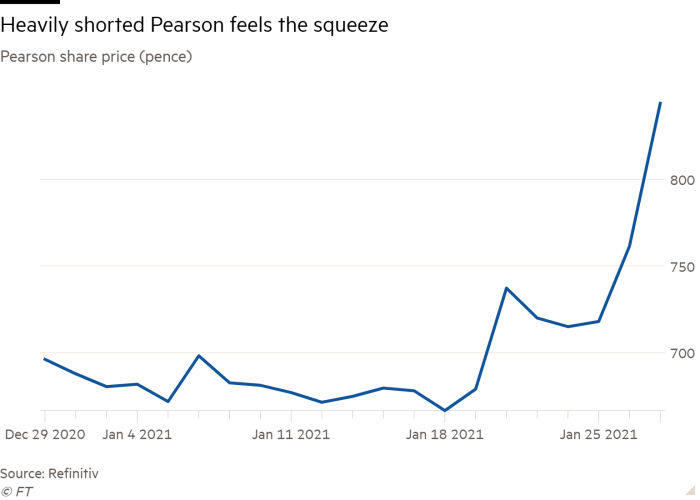

Heavily shorted shares with no link to Melvin Capital also rose on Wednesday. Shares in Pearson, the British education publishing company that is the third-most shorted stock in Europe, according to IHS Markit, were up 12 per cent by mid-afternoon in London. Daniel Sundheim’s New York-based hedge fund D1 Capital Partners, which has also been shorting Varta, has the biggest bet against Pearson, at 3.8 per cent of its share capital.

Real estate company Wereldhave, in which Woodson Capital has disclosed a 4.2 per cent short position and London-based Adelphi has a 3.6 per cent bet, rose about 5 per cent.

Hedge funds in Europe are now fervently scouring lists of most-shorted stocks and message boards such as Reddit for any signs that their short bets could be in trouble.

“Any good hedge fund group will be looking at this,” said the head of one multibillion-dollar European hedge fund firm.

One European hedge fund manager who specialises in short selling described the recent stock market rallies as “insane”, but said the elevated share prices of troubled companies would “make a great opportunity” for short sellers that survived the week’s mayhem.

"Short" - Google News

January 27, 2021 at 10:48PM

https://ift.tt/3oit0Cg

‘Short-squeeze’ spreads to Europe as day traders hunt next GameStop - Financial Times

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "‘Short-squeeze’ spreads to Europe as day traders hunt next GameStop - Financial Times"

Post a Comment