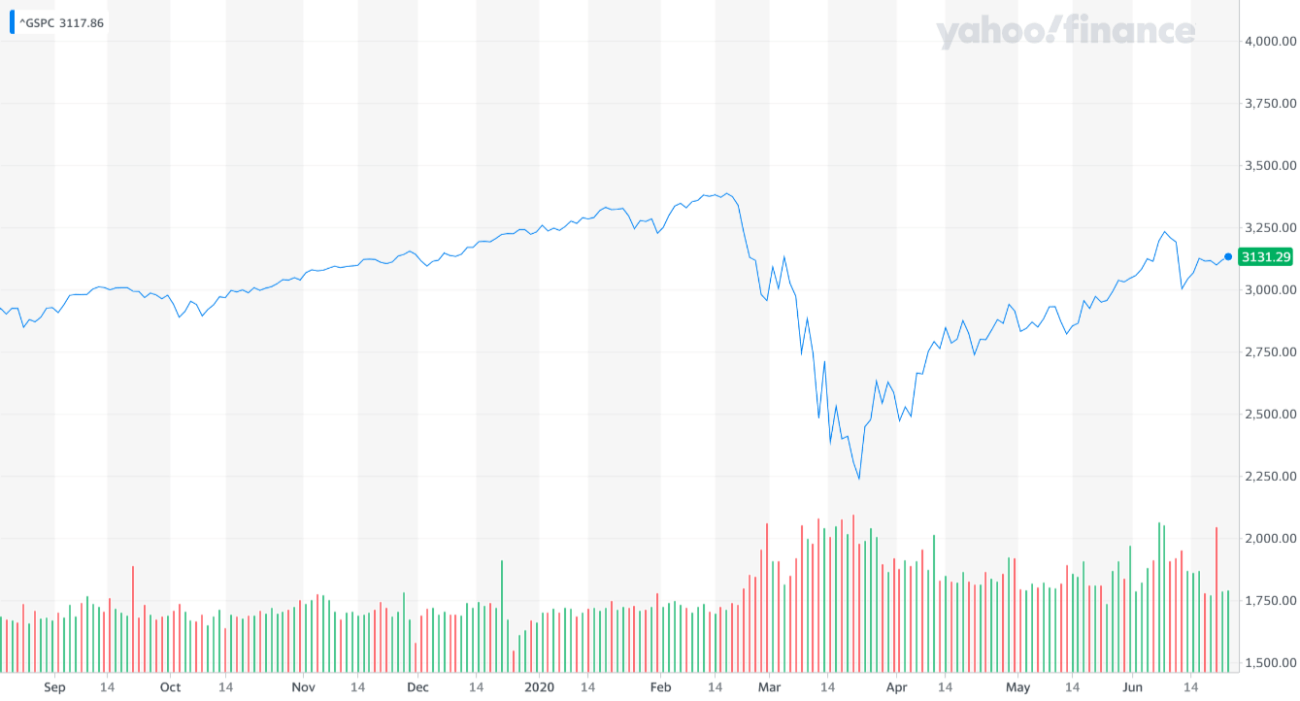

- The total number of short contracts in the U.S. stock market this month is six times higher than in May.

- Wells Fargo says the selling pressure from pension funds can drive a downturn in equities.

- JPMorgan strategists argue the trend of the equities is highly optimistic, and any dip will likely get bought.

Investors in the U.S. stock market are holding 303,000 S&P 500 short futures contracts – a level unseen since 2011. More traders are expecting a downturn in equities than in March.

The U.S. stock market remains cautiously optimistic, as equities continue to rally as a result of relaxed financial conditions.

But, the increase in selling pressure on equities at this time can increase the likelihood of a major crash. The risk of a pullback further intensifies when institutions generally sway to cash and hedge positions.

The Case for a Massive Stock Market Plunge in the Near-Term

Strategists expect two primary scenarios in the short-term: stock market falls as sell orders mount or a short squeeze occurs.

Analysts anticipate a stock market plunge because of the increase in the number of traders shorting the market compared to March or April.

Pension funds and institutions will also look to take profit from recent stock market gains, which may cause a downturn.

Wells Fargo executive Michael Schumacher warned the upsurge of the S&P 500 might lead pensions to move billions of dollars.

Schumacher, the bank’s director of rates strategy, said:

We estimate that U.S corporate pensions will move about $35 billion into fixed income. The reasons are pretty obvious. You had this massive rally in stocks and bonds haven’t been keeping pace.

Arguments For a Short Squeeze

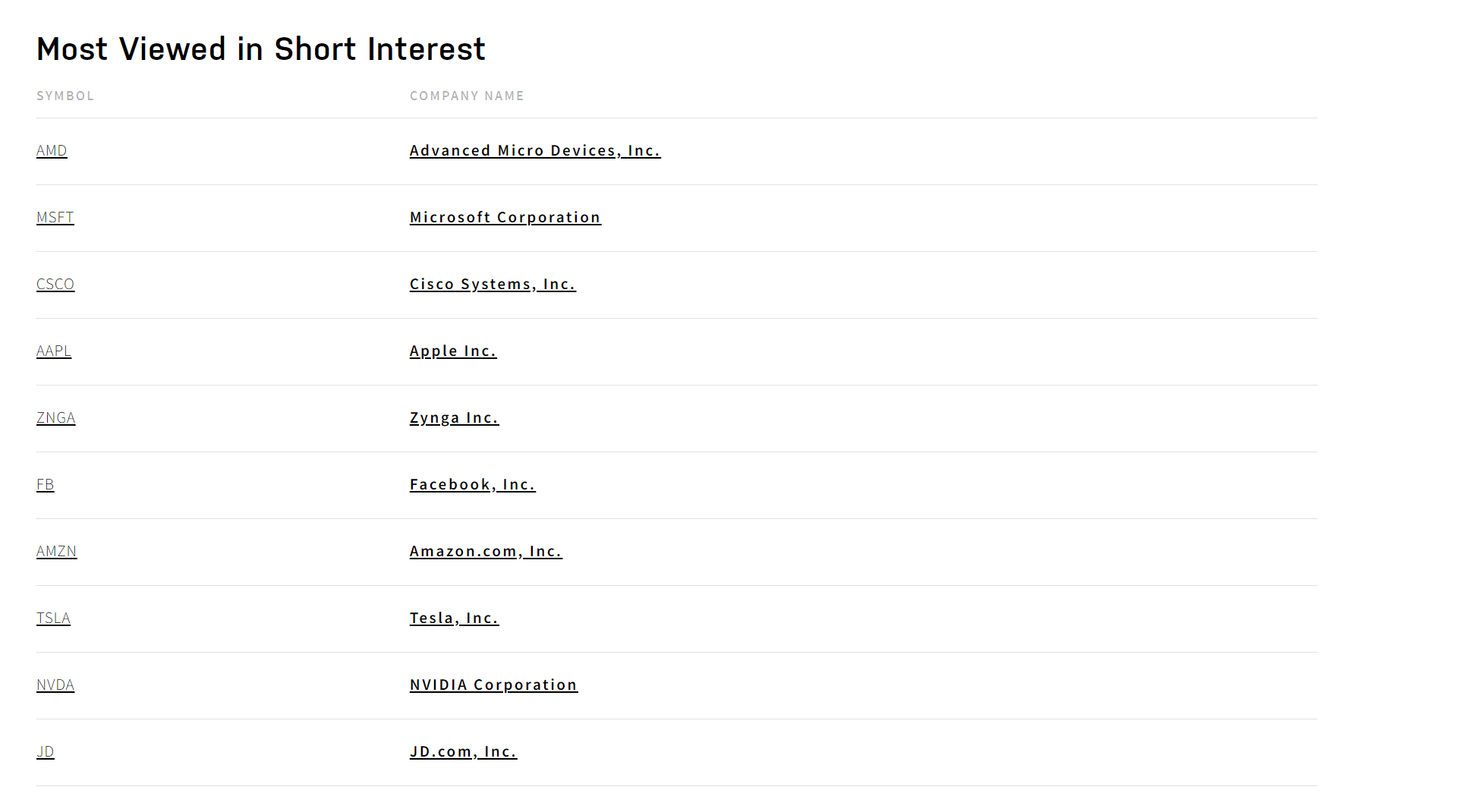

When the number of short contracts builds upon an index, it can leave the index vulnerable to a short squeeze.

The term short squeeze refers to the liquidation of short futures contracts turning into buying demand.

For instance, when a trader shorts the S&P 500 index but the index goes up, the trader needs to adjust the position. If the trader exits the position, the trader has to market-buy his entire position.

If a cascade of short contracts get liquidated or force traders to adjust positions, it can cause the stock market to surge.

Based on the recent trend of the stock market, JPMorgan strategists believe the selling pressure will be absorbed.

The strategists said:

While we acknowledge the risk of a small correction in equity markets over the coming two weeks… any dip would represent a buying opportunity.

The most critical variable in the short-term

The U.S. stock market plummeted in March due to the economic consequences of the pandemic.

As such, the rate of the spread of the virus is still a major variable that can affect the stock market.

Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, expects more virus complications in young people.

If the stock market is pricing in a smooth reopening of the U.S. economy, any negative data about the virus can add to the uncertainty of investors.

"Short" - Google News

June 24, 2020 at 04:27PM

https://ift.tt/3ev071F

Short Investors Tempt Volatility Betting Against Historic Stock Market - CCN.com

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "Short Investors Tempt Volatility Betting Against Historic Stock Market - CCN.com"

Post a Comment