(Bloomberg) -- Retail trading favorite Cassava Sciences Inc. has sold off amid concerns over trial data on its Alzheimer’s drug, earning short sellers more than $100 million over the past month, according to data from S3 Partners.

The recent moves put the stock at the center of the latest standoff between retail traders and short sellers, which are often hedge funds or institutional firms banking on declines in a stock. Bearish bets have been placed against about 13% of the biotech’s float or roughly $293 million, according to S3.

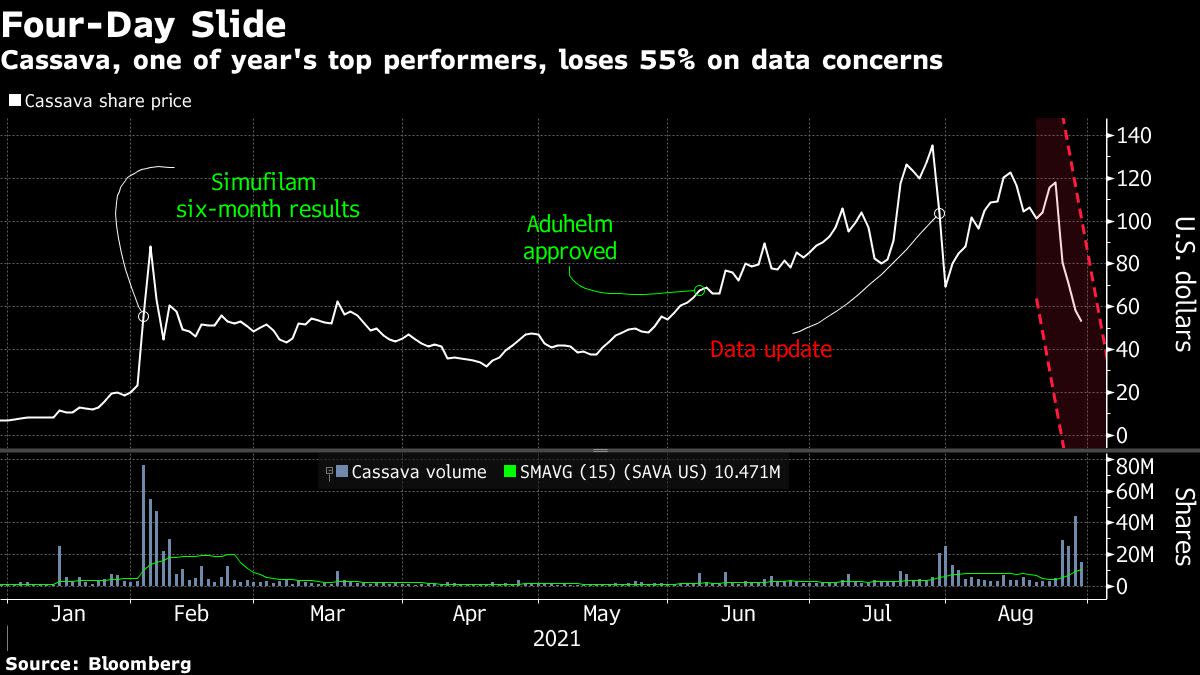

Cassava’s shares took a beating last week after a lawyer backed by a short seller filed a petition to halt trials of the company’s main asset, an experimental Alzheimer’s disease treatment, on concerns over the integrity of the data. Selling accelerated on Friday when Quanterix Corp., the lab Cassava cited as generating the data, distanced itself from the results, saying it hadn’t interpreted them or prepared information presented at a recent industry conference. An analyst with Cantor Fitzgerald on Friday said it was impossible to perform his due diligence and suspended his hold rating on the stock.

“Avowed short sellers are circulating allegations of scientific impropriety,” Remi Barbier, Cassava’s chief executive officer, said in an emailed statement. “They stand to make an enormous financial profit from a drop in the Cassava Sciences’ stock.”

Cassava has previously said that that Quanterix’s only duty in the trial was to perform sample testing and that it saw the petition “as a technique intended to add to the pile of fear and doubt generated by their initial document.”

Even after losing about 55% in the past four trading days, the stock is still the second best performer in the Russell 2000 this year. Retail traders jumped into the stock at the beginning of the year after early data in a small study -- whose results are now being questioned -- were seen as positive for the treatment. Regulatory approval of Biogen Inc.’s controversial Aduhelm renewed optimism over the chances of smaller biotech also finding success in Alzheimer’s disease treatment and helped push the stock to nearly a 20-fold yearly gain by July.

After initially snapping up Cassava shares on the recent downturn, there are signs day traders are losing interest once again.

“Retail investors were buying the dip aggressively last Wednesday during the first leg of the sell-off. Then, they turned net sellers on Thursday when the stock continued to drop,” said Giacomo Pierantoni, an analyst with Vanda Research, a firm that tracks retail trading.

Even with the recent selloff, shorts that have been betting against Cassava’s stock for longer have yet to recoup all their losses. Short sellers are still down about $240 million so far this year, according to S3’s Ihor Dusaniwsky.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

"Short" - Google News

August 31, 2021 at 06:15PM

https://ift.tt/38xeKzW

Cassava Short Sellers Reap $100 Million in August Stock Rout - Yahoo Finance

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "Cassava Short Sellers Reap $100 Million in August Stock Rout - Yahoo Finance"

Post a Comment