Spooked by a retail revolution, institutional investors continue to pare back short positions in U.S. stocks.

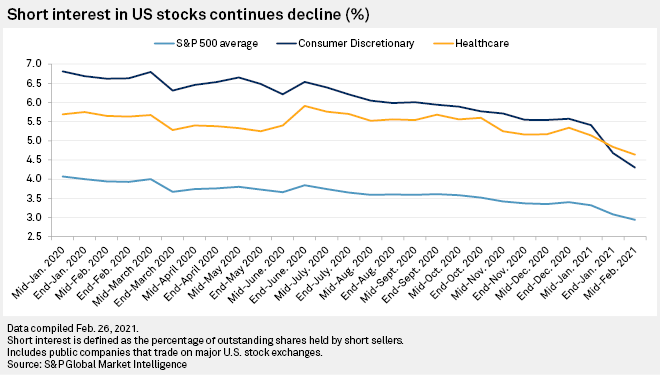

As of mid-February, the percentage of outstanding shares of S&P 500 constituent companies held by short-sellers averaged 2.94%, down 100 basis points from 3.94% in mid-February in 2020, according to the latest S&P Global Market Intelligence data. Since a Reddit-fueled short squeeze of video game retailer GameStop Corp. early in 2021, short interest in S&P 500 shares has fallen 46 basis points from an average of 3.4% at the end of December 2020 to 2.94% at mid-February.

Short interest in the consumer discretionary sector, the most shorted sector for most of 2020, fell 127 basis points, from 5.57% at the end of December to 4.3% at mid-February. It has dropped behind healthcare as the index's most popular with short-sellers.

"The meme stock saga has made quite a few hedge fund managers gun shy about shorting," said Michael Crook, deputy chief investment officer at Mill Creek Capital Advisors, in a Feb. 26 interview. "We've heard from a number of hedge fund managers that they don't want to get caught up in another GameStop scenario and have reduced short exposure for now."

Short-sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If their plays are successful, short-sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

Hedge funds, however, have taken a cautious approach to short selling since they were taken on a rollercoaster ride by retail investors who piled into GameStop shares, driving the shares up and inflicting losses on short positions. GameStop stock spiked from below $20 on Jan. 12 to nearly $348 at the close Jan. 27. It settled below $54 on Feb. 4 but closed March 1 at $120.40.

"Short interest will likely normalize over time, but I expect hedge fund managers will be much more careful around positions with high overall short interest since those are easy to identify as short squeeze targets," Crook said.

Short interest in mid-February fell in all 11 sectors. Social Capital Hedosophia Holdings Corp. V, a financial technology company, was the most shorted company as of mid-February, with short interest of nearly 40.8%, according to Market Intelligence data. GameStop's short interest, which was nearly 108% as of mid-October, fell below 24% in mid-February, according to the data.

"From the GameStop perspective, the risk-reward is not there if the equivalent of a digital mob looks to squeeze shares higher regardless of fundamentals or price," said Michael O'Rourke, chief market strategist at JonesTrading, in a March 1 interview. "Investors looking to hedge their portfolios are better served using index futures."

In addition to the fear of a short squeeze, O'Rourke said the decline in shorts was also motivated by the "liquidity drive bubble environment" of the current stock market.

"Investors are less incentivized to make short bets when prices are very disconnected from fundamentals," O'Rourke said. "They will be more selective waiting for a catalyst event that they believe will move the shares in the expected fundamental direction."

The S&P 500 increased 2.76% on a total return basis in February, after slipping about 1% in January.

The S&P 500 has five separate record high settlements in February.

The February rally was led by the energy sector, which jumped more than 22.6% on the month, as crude oil prices continue to rise on prospects of a rebound in petroleum demand. Financials climbed nearly 11.5%.

Healthcare stocks fell more than 2.1% on the month, the largest decline of any sector except utilities, which fell over 6.1%.

"Short" - Google News

March 03, 2021 at 02:32PM

https://ift.tt/3bZ7C0Q

S&P 500 short interest retreats further as hedge funds remain wary - S&P Global

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "S&P 500 short interest retreats further as hedge funds remain wary - S&P Global"

Post a Comment