The Federal Reserve Bank of New York’s 2022 SCE Housing Survey shows that expected changes in home prices in the year ahead increased relative to the corresponding timeframe in the February 2021 survey, while five-year expectations remained unchanged. Households reported that they would be less likely to buy if they were to move compared to the year-ago survey, marking the first annual decline since the series began in 2014. This drop was driven by current renters, who were much less likely to buy compared to renters in the 2021 survey. Renters also reported that they expect rents to be sharply higher twelve months from now, with the expected rate of increase more than twice that reported a year ago. The expected price of rent five years ahead also rose compared to expectations a year ago, but at a more moderate pace.

The SCE Housing Survey

This latest survey marks the ninth installment of the annual SCE Housing Survey, which has been fielded every February since 2014 and is part of the broader Survey of Consumer Expectations. The 2022 survey includes 1,242 respondents, about one-quarter of whom are current renters while the remaining three-quarters are homeowners. Results are presented in the SCE Housing Survey interactive web feature, which shows time trends for variables of interest for the overall sample as well as for various demographic groups, including separate splits for owners and renters. For further information on the SCE, please refer to an overview of the survey methodology, the interactive chart guide, and the survey questionnaire.

The primary goal of the SCE Housing Survey is to provide rich, high-quality information on consumers’ experiences, behavior, and expectations related to housing. The survey collects data on households’ perceptions and expectations for changes in home prices and rents, as well as their intentions regarding moving and buying in the future, perceptions of mortgage rates, and the ease of obtaining a mortgage. The survey also elicits preferences for owning and renting, and contains geographic information to study variation in responses.

One-Year Home Price Expectations Accelerate, Five-Year Expectations Unchanged

Survey respondents estimated the value of a typical home in their zip code and reported their expected value of that home in one and five years. The evolution of home price expectations, annualized at the five-year horizon, is shown in the chart below.

Households Expect Strong Home Price Growth in the Short Term

The expected change in home prices over the next year rose relative to twelve months earlier, with households expecting home prices in their zip code to rise by 7.0 percent on average, compared to 5.7 percent in February 2021. This increase, despite an increase in mortgage rates nationally since summer 2021, reflects strong momentum in home prices over the past eighteen months. In contrast, five-year expectations remained unchanged, with households expecting an annualized growth rate of 2.2 percent. The divergence in one- and five-year expectations suggests that households foresee strong home price growth in the short term, but that prices will moderate in the longer term.

The divergence in households’ one- and five-year home price expectations was broad-based across age and education groups but was most pronounced for households with annual income of less than $60,000. Despite significant outward migration from urban centers since the onset of the pandemic (Ramani and Bloom, 2021), urban and rural households reported similar home price expectations over the short and medium term. We also found no major differences in the short- and medium-term home price expectations between owners and renters.

The divergence of one-and five-year home price expectations is consistent with households expecting mortgage rates to continue to increase in the near term. We asked respondents what they thought the average mortgage interest rate on a thirty-year fixed-rate mortgage was today, and what they thought it will be in one and three years. Respondents reported higher one- and three-year expected mortgage rates relative to pre-pandemic levels. The expected 8.23 percent rate in three years is the highest level in the series’ nine-year history.

Average Perceived National Mortgage Rate

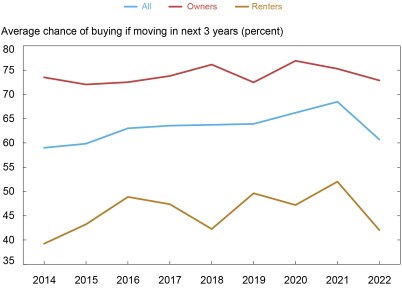

To assess whether the expected slowdown in home prices over the medium term is due to a shift in attitudes regarding the attractiveness of housing as an investment, we asked respondents how likely they would be to buy as opposed to renting if they were to move over the next three years. Households also reported that they would be less likely to buy if they were to move compared to a year ago. This was the first annual decline in this series since the survey began in 2014, and was driven by current renters, who were about 10 percentage points less likely to buy compared to renters in the February 2021 survey. We also asked respondents how they viewed the attractiveness of housing as an investment relative to other financial investments. The fraction stating that housing is a “good” or “very good” investment fell slightly to 71.0 percent, compared to its series high of 73.6 percent in February 2021.

Renters Are Less Likely to Buy if They Were to Move in Next Three Years

Renters Becoming More Pessimistic about Housing Market as Expected Rents Spike

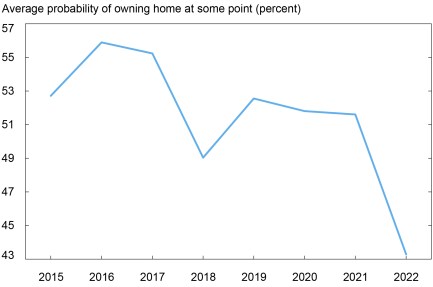

To understand why renters report being less likely to buy if they were to move, we asked how changes in home prices over the past year have affected their housing plans. Twenty-two percent of households reported that they had planned to purchase a home but now view renting as a better financial decision. About 13 percent of respondents stated that the recent increase in home prices had prompted them to speed up their search to purchase a home over the past year. However, the majority of respondents either preferred to rent (36 percent) or said they were waiting for prices to come down before buying (42 percent). We also asked renters how likely it was that they would own a home at some point in the future. The average likelihood fell below 50 percent for the first time in the series’ history.

Renters See a Lower Likelihood of Ever Owning a Home

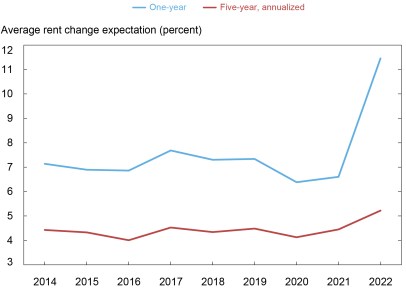

If renters previously on the margin of purchasing a home no longer find homeownership as appealing, a key question becomes how are expectations of rental prices evolving? We asked respondents to estimate the rental value of a typical home or apartment in their zip code, and what they think the rent will be one and five years from today.

Households Expect Large Rent Increases in the Short Term

Households expect a sharp rise in rents over the next twelve months: on average, respondents expect rents to increase by 11.5 percent, compared to 6.6 percent in the February 2021 survey. This increase was even more pronounced among current renters, who expect rents to rise by 12.8 percent one year from now compared to 5.9 percent one year ago. This is consistent with the idea that short-term rent expectations are being shaped by the sharp increases in rent that have occurred in recent months. The expected price of rent five years from now rose to an annualized increase of 5.2 percent, compared to 4.4 percent a year ago.

Finally, we are also releasing a chart packet that describes our sample and presents summary statistics for many more questions that were asked in the survey. This year’s survey also included special modules on climate change and evictions, which we will write about in the near future.

Fatima-Ezzahra Boumahdi is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Leo Goldman is a senior research analyst in the Bank’s Research and Statistics Group.

Andrew Haughwout is a senior vice president in the Bank’s Research and Statistics Group.

Ben Hyman is an economist in the Bank’s Research and Statistics Group.

Haoyang Liu is a senior research economist at the Federal Reserve Bank of Dallas.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

"Short" - Google News

April 18, 2022 at 10:01PM

https://ift.tt/6S5d4E0

Expected Home Price Increases Accelerate over the Short Term but Remain Stable over the Medium Term - Liberty Street Economics - Liberty Street Economics -

"Short" - Google News

https://ift.tt/w4MuPE5

Bagikan Berita Ini

0 Response to "Expected Home Price Increases Accelerate over the Short Term but Remain Stable over the Medium Term - Liberty Street Economics - Liberty Street Economics -"

Post a Comment