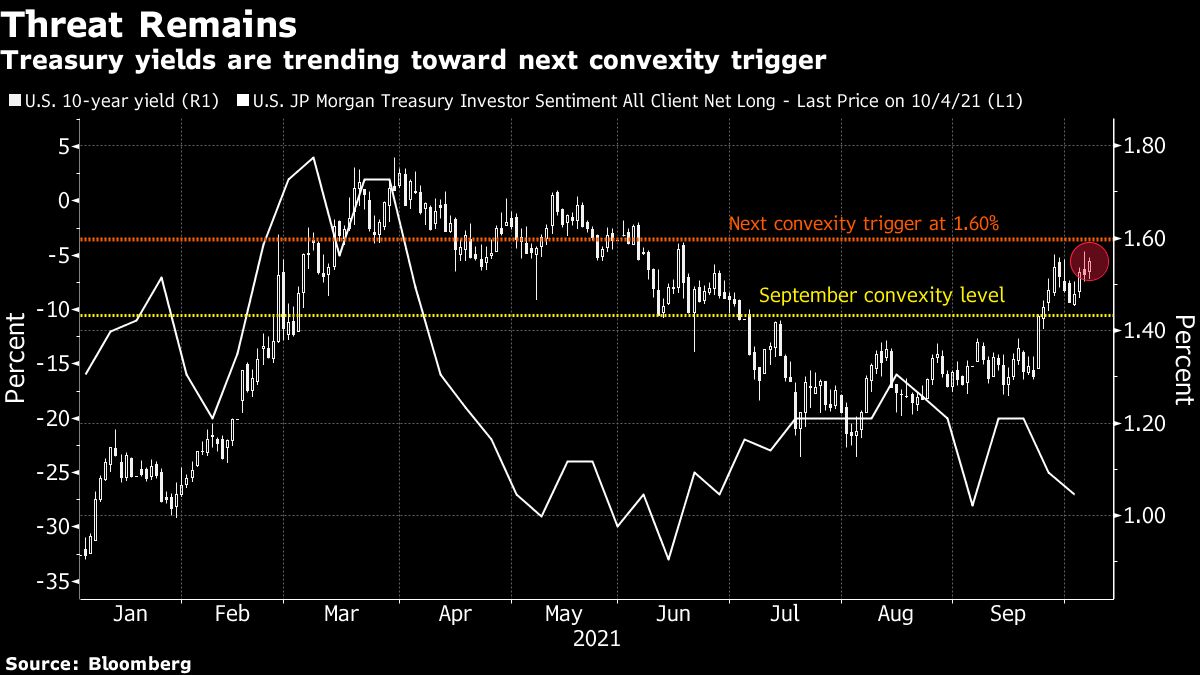

Bond investors are piling back into short positions, motivated not only by the specter of inflation but also by the risk that yields are approaching a level that will unleash a wave of new selling by convexity hedgers.

That level is around 1.60% in the U.S. 10-year Treasury yield, less than five basis points from its current mark and the highest since early June, according to Brean Capital’s head of fixed income strategy, Scott Buchta. It’s the midpoint of “a key threshold” in the range of 1.40% to 1.80%, an area “most critical from a convexity hedging point of view.”

"Short" - Google News

October 08, 2021 at 12:18AM

https://ift.tt/3ll4oL2

Big Short Builds in U.S. Bonds on Wariness of Convexity Trigger - Bloomberg

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "Big Short Builds in U.S. Bonds on Wariness of Convexity Trigger - Bloomberg"

Post a Comment