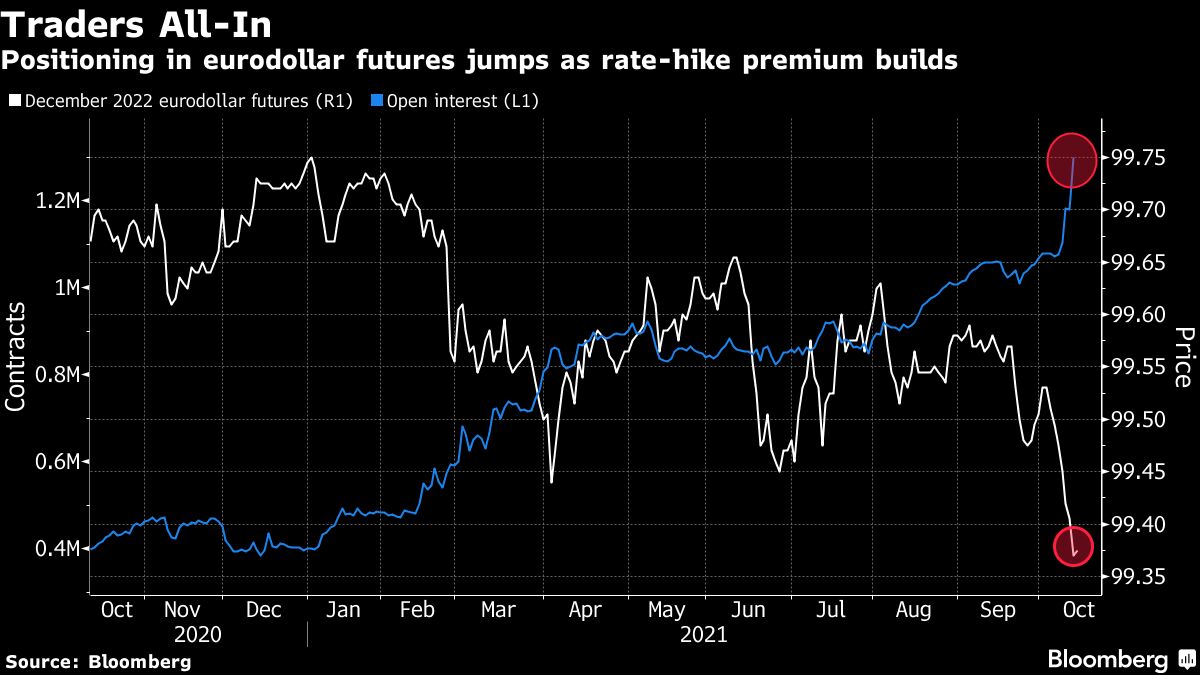

Traders in a key corner of the U.S. short-term rates market are ramping up short positions in futures amid growing expectations that the Federal Reserve will hike faster and more aggressively starting at the end of next year.

In the wake of Wednesday’s stronger-than-forecast consumer-price report, preliminary CME Group Inc. data on eurodollar futures show that open interest -- the number of contracts in existence -- surged in a number of expiration dates through the end of 2022.

"Short" - Google News

October 14, 2021 at 08:01PM

https://ift.tt/3ABlSqV

Traders Go All-In on 2022 Fed Hike as Futures Short-Bets Surge - Bloomberg

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "Traders Go All-In on 2022 Fed Hike as Futures Short-Bets Surge - Bloomberg"

Post a Comment