Turkey has fined banks including Goldman Sachs, Bank of America and JPMorgan over alleged irregularities in short selling just a week after foreign investors pulled $1.9bn from the country’s stock and bond markets.

The Capital Markets Board said late on Thursday that 10 securities firms had placed orders for short selling without proper notification, violating rules enacted last July that temporarily prohibited such transactions. The board’s notice did not provide further details and a spokesman for the regulator could not be reached.

Credit Suisse was fined TL7.8m ($1m), while Barclays was fined TL7m and Bank of America was hit with a TL6.3m fine. JPMorgan and Goldman Sachs must pay TL1.2m and TL871,000, respectively. HSBC, UBS, Renaissance, Moon Capital Master Fund and Wood & Co. were fined between TL188,000 and TL1.4m. The financial firms either declined to comment or did not respond to a request for comment by publication time.

The fines may be small but form part of a pattern. Last July, the stock exchange banned Goldman Sachs, JPMorgan, Bank of America, Barclays, Credit Suisse and Wood & Co. from short selling stocks in publicly traded Turkish companies for three months. The transactions in question occurred last year, Bloomberg reported.

In late March, foreign investors dumped Turkish stocks, bonds and the lira after President Recep Tayyip Erdogan suddenly fired Naci Agbal, the central bank governor who had served just four months in the role and was widely credited with restoring confidence after a series of large interest-rate rises to stabilise the lira and tame inflation. Instead, the president installed an academic and newspaper columnist who shares Erdogan’s unconventional view that high interest rates drive inflation.

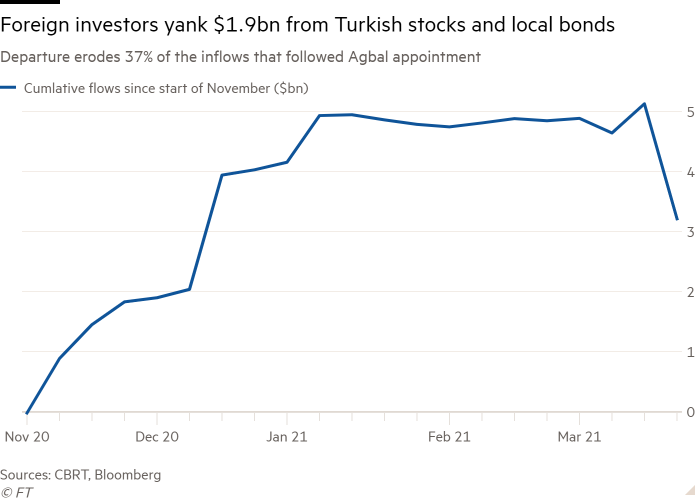

A report released by the central bank this week underscored the scale of the investor flight prompted by Erdogan’s abrupt firing of Agbal. Foreign investors pulled $814m from the stock market and $1.1bn from local bonds in the week of March 26, according to data collated by Bloomberg. The outflow eroded 37 per cent of the $5.1bn in new money that flowed into Turkey since early November following Agbal’s appointment.

Sahap Kavcioglu, the new central bank governor, addressed investors on Thursday, repeating a pledge to maintain tight monetary policy, according to three participants who asked not to be named because the meeting was closed to the press.

Asked about his previously stated views on the link between interest rates and inflation, Kavcioglu acknowledged that market participants' concerns were “understandable” but they should wait to “judge” him until after April, when the monetary policy committee will hold its next rate-setting meeting, one person on the call said.

Another person said he did not feel “any more reassured” after the call, when Kavcioglu deferred to a deputy to answer many of the questions asked by investors.

Two participants on the call added that they were still left in doubt over how much sway Kavcioglu would have in setting monetary policy given deep concerns over central bank independence.

Yigit Bulut, an economic adviser to Erdogan, said: “The markets like the central bank governor, especially after yesterday’s meeting, when there was real cohesion.”

The lira traded at around 8.05 to the US dollar on Friday, stronger than before the Kavcioglu meeting with investors, but much weaker than the TL7.22 level it traded at ahead of Agbal’s sacking.

Turkish residents cut their foreign exchange deposits by $8.9bn in the week to March 26, a 3.8 per cent decline on the previous week, according to the central bank. Bulut said this showed Turkish citizens had stepped in to support the lira.

"Short" - Google News

April 02, 2021 at 11:26PM

https://ift.tt/3rKvCKQ

Turkey fines foreign banks for ‘short selling irregularities’ - Financial Times

"Short" - Google News

https://ift.tt/2QJPxcA

Bagikan Berita Ini

0 Response to "Turkey fines foreign banks for ‘short selling irregularities’ - Financial Times"

Post a Comment